Dear valued customer,

The customs procedure for handling clearances Declarations is changing from (CHIEF) to the new Customs Declarations Service (CDS)

This will be turned off in two stages:

– Imports On the 30th September, 2022 – The option to use this procedure will end.

– Exports On the 31st March, 2023 – The option to use this procedure will end.

HMRC have brought this in as a result of brexit and as a result of modernising the whole clearance platform

Key points

- You must have a valid EORI registration if you do not already hold one. https://www.gov.uk/eori/apply-for-eori

- You must have Government Gateway account if you do not already hold one. https://www.gov.uk/government/publications/customs-declaration-service-communication-pack/trader-checklist-moving-to-the-customs-declaration-service

- You must register to use CDS using your Government Gateway ID. https://www.gov.uk/guidance/get-access-to-the-customs-declaration-service

ONCE YOU ARE REGISTERED YOU SHOULD RECEIVE A REFERENCE CODE. PLEASE SHARE THIS WITH US TO COMPLETE THE PROCEDURE

For customers with Duty deferment Accounts only

- If you have a Duty Deferment Account (DDA) you need to complete a new direct debit mandate within CDS.

- You have to authorise the Customs Agent(s) within CDS using their EORI number as shown below. *this step is only required if you have a Duty Deferment Account*

****************************

As an example

Customs Agent EORI number is GB000000000000001

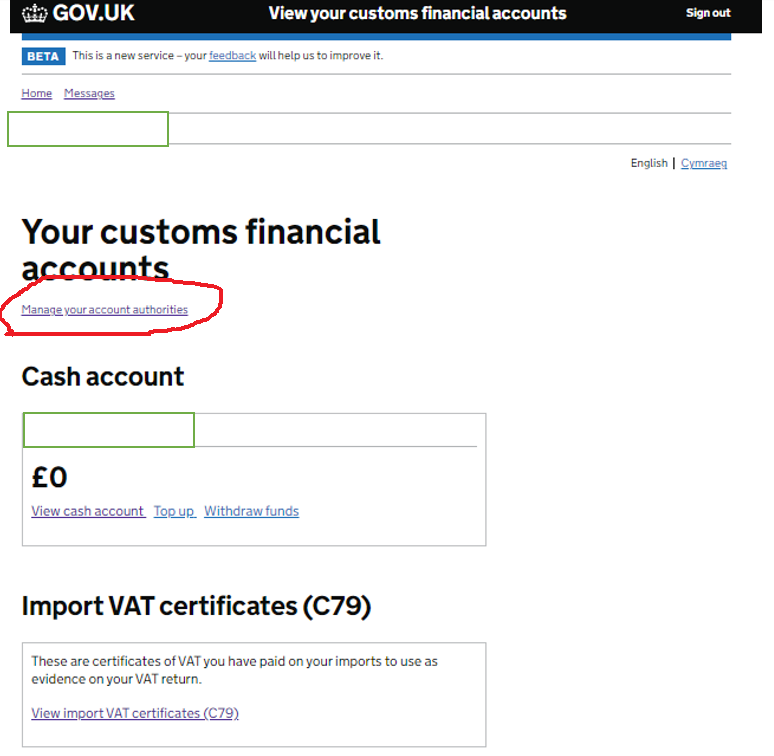

When you log in to your CDS account, the following option will be available `Manage your account authorities`

After selecting the option, you must input the above highlighted agents EORI number.

If you do have a Duty deferment Account please get in touch with our office by replying to this email, and we will provide you with the correct EORI details to input into your CDS account.

****************************

For more information see below:

Please see the following link for more information regarding the financial options available in CDS

Furthermore, please see the Q&A document where you can find a list of answers for most common questions. The document is divided by sections such as general questions, registration, financial etc. to make it easier to find the relevant topic

https://bifa.org/media/4928658/hmrc-cds-qa-08062022.pdf

In addition, please see the checklists listing the sign-up requirements for:

TRADER

Please see below the webinar slides shared by HMRC which gives a detailed overview of the CDS system and the requirements

https://bifa.org/media/4878810/town-hall-preparing-to-move-to-the-customs-declaration-service.pdf

our offices remain at your disposal

Thank you,

Oliwia Kuczkowska

Customer Service

Con-Tra UK